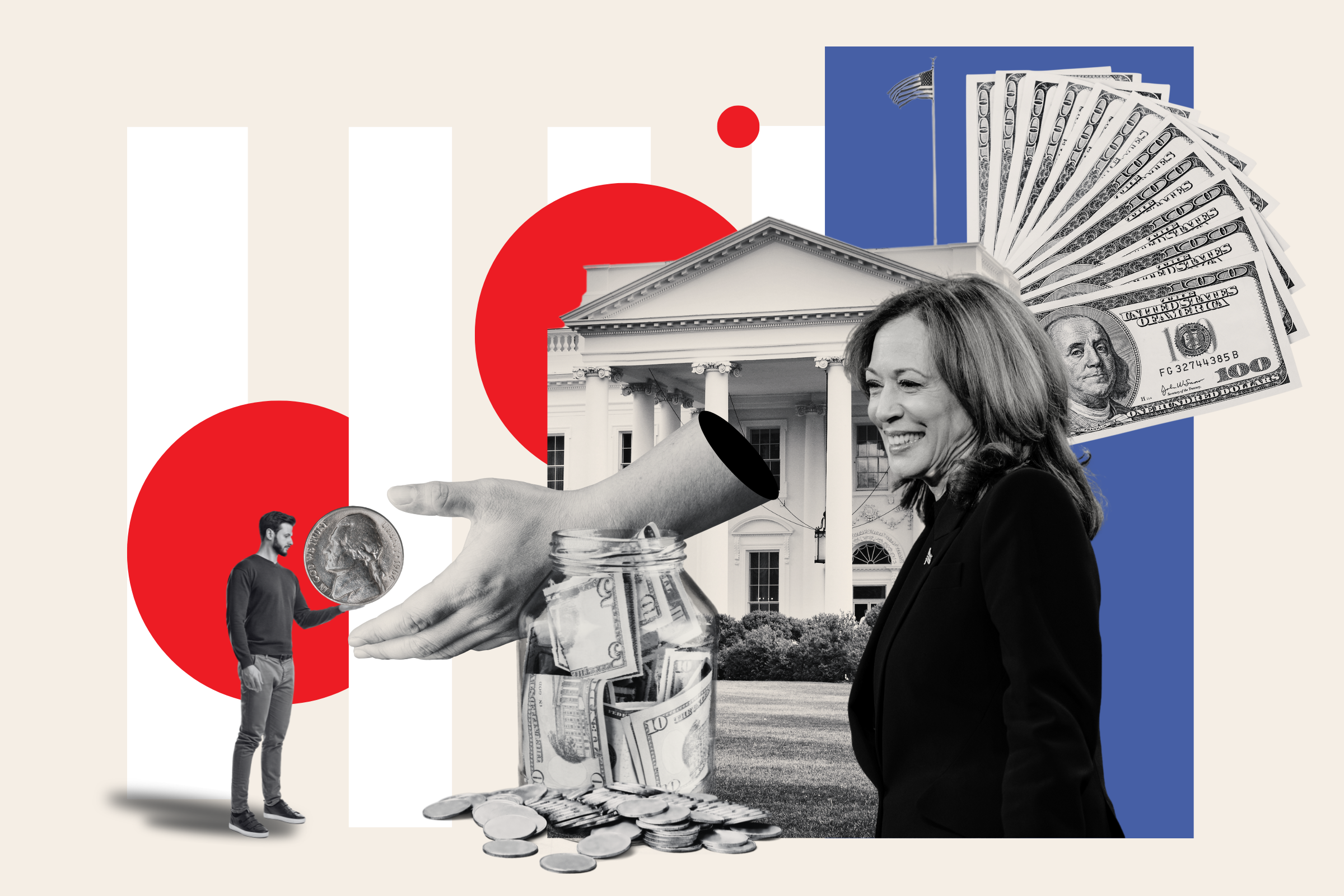

As the Democratic candidate aiming for the presidency this November, Kamala Harris is crafting her policy agenda for a potential transition from vice president to president.

Key Tax Proposals from Harris

So far, Harris has laid out several fiscal strategies, including increasing corporate tax rates, eliminating taxes on tipped income, and expanding benefits under the child tax credit.

“Together we will build what I call an opportunity economy,” she remarked during a rally in North Carolina. “Strengthening the middle class will be a top priority for my presidency because I believe that when the middle class thrives, America thrives.”

Raising Corporate Taxes

Harris advocates elevating the corporate tax rate from 21 percent to 28 percent. This comes after the Trump administration reduced it from 35 percent to its current level as part of the Tax Cuts and Jobs Act.

A spokesperson for Harris stated that this measure aims to responsibly return funds to working-class families while ensuring that wealthy individuals and large corporations contribute their fair share.

Estimates indicate that increasing the corporate tax rate could generate between $1 trillion and $1.2 trillion over the next decade.

Income Tax Adjustments for High Earners

Aligning with President Biden, Harris has confirmed that those earning under $400,000 will not see tax hikes. She plans to raise the highest marginal income tax rate to 39.6 percent from the current 37 percent.

Tax Relief for Service Workers

In a policy shift similar to former President Trump’s, Harris has expressed support for eliminating federal income taxes on tips earned by service workers. She emphasized her commitment to uplifting working families, stating, “When I am president, we will continue our fight for working families in America.”

Nevertheless, experts caution that this change could complicate the tax system and significantly reduce federal revenue, with estimates suggesting a potential loss of $150 to $250 billion over a decade.

Expanding the Child Tax Credit

Another proposal is to reinstate the enhanced child tax credit first introduced during the pandemic. During a speech in Raleigh, North Carolina, Harris announced that her plan would provide families with $6,000 for newborns during their first year, surpassing the previous increase from $2,000 to $3,600 per child.

“We will provide $6,000 in tax relief to families during the first year of a child’s life,” she assured supporters.